Practice Management

ELIGIBILITY

ELIGIBILITY

|

Insurance companies regularly make policy changes and updates in their health plans. Therefore, it is inevitable for the medical billing company or the provider to verify if the patient is covered under the new plan to help achieve maximum benefits of insurance eligibility verification. We confirm or verify with the insurance representative whether the current policy is active or terminated or the dependent is covered or not; which facilitates acceptance of the claim on the first submission, whereas, non-verification leads to several denials from insurance or clearing house through scrubber which may increase the work for billers and the denials may cause painful headache for the physicians. In order to overcome this situation, the eligibility verification is necessary for the encounter to be taken place. |

BENEFITS VERIFICATION

BENEFITS VERIFICATION

Benefits verification services include verification of: payable benefits, co-pays, co-insurances, deductibles, patient policy plan name, type of network applicable for reprising of claims, coverage, effective date, plan exclusions, claims mailing address, referrals & pre-authorizations, out of pocket maximum and more. Other optional services which are provided as part of patient eligibility verification process include:

- Obtaining pre- authorization number

- Reminding patients of POS collection requirements

- Obtain referral from PCP

- Inform clients if there is an issue with coverage or authorization

CHARGE ENTRY

CHARGE ENTRY

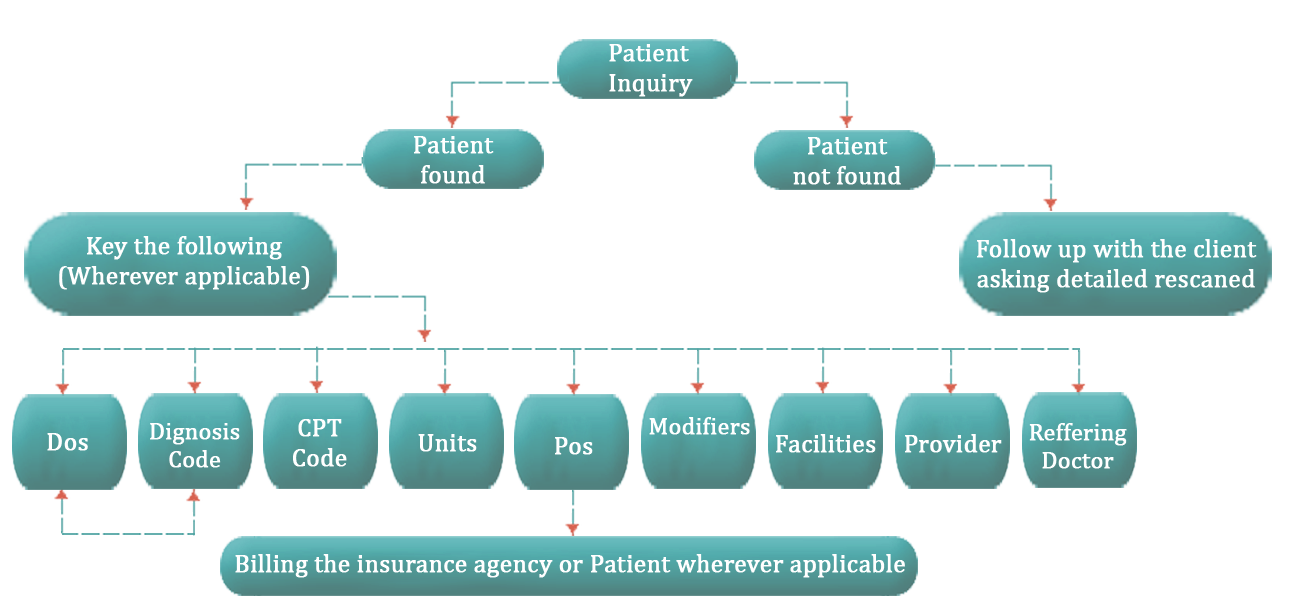

We follow a well-structured charge entry process. The filtered steps followed through the process ensure that relevant audits are made at each level. This enables us to manage a zero or may be less error to take place and provide our services to you with speed and maximum efficiency.

Our Billing Resources team has unique experience with the knowledge of the US healthcare industry, and offers expert skills in facilitating investigations and enabling quality decision-making.

The varied steps we manage within our charge entry process are described below :

CLAIMS SUBMISSION

CLAIMS SUBMISSION

Electronic filing:

The electronic submission of claims and other supported HIPAA transactions saves time feature and decreases your paperwork and reduces payment errors, ensuring quick payment. The suite of electronically acceptable claims through the clearing house includes primary claims, secondary claims and adjustments.

Paper filing:Paper claims filing is also a part of claims submission. The claims which require further information in order to process the claims correctly and fair reimbursement to the physician in regards to their efforts; the paper claims filing has been recommended to ensure insurance to process quickly and accurately. This reduces manual keying errors and improves the response time on your paper claims.

PAYMENT POSTING

PAYMENT POSTING

Payment posting helps you post the insurance payments automatically with ERAs, and streamlining manual payment posting which improves productivity and saves time.

As you are posting payments, you can view a full transaction history on each charge and drill-down into the encounter for more details. Finally, you can post your insurance payments by batch and generate batch reports to reconcile to bank deposit slips.

A/R FOLLOW-UP

A/R FOLLOW-UP

Our accounts receivable follow-up is a process specifically designed for the payment not processed by the insurance company or take back if any has been made due to incorrect processing of claims from insurances

Every month our Accounts Receivable team runs the ageing report and follows up on all unpaid and partly paid claims. We also work on eligibility and benefitis verification which reduces the denials and maximize payment. We further work on the claims to reprocess, appeal, and send medical records where required. In short we make sure that the provider gets the best possible or feasible reimbursement for the services they have rendered. All this is done keeping relevant deadlines and timely filing limits in mind